Level 4 Diploma in Stock Trading - QLS Endorsed

Level 4 QLS Endorsed Training | 120 CPD Points | Free PDF Certificate | 24/7 Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- QLS Endorsed Hardcopy Certificate - £79

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Embarking on a journey through the realms of stock trading is both thrilling and complex. The Level 4 Diploma in Stock Trading - QLS Endorsed course stands as a beacon of knowledge, guiding learners through the intricate labyrinth of the stock market. It's a world where every decision counts, and this course is designed to arm you with the acumen and insight needed to navigate these waters. Imagine yourself at the helm of your trading ventures, making informed decisions backed by a deep understanding of market dynamics. This course is your compass.

Diving deeper, the Stock Trading course curriculum is meticulously crafted to cover a broad spectrum of essential topics. From the fundamentals of stock and market indices to the nuanced strategies of investment theories, each module is a stepping stone to mastering the art of stock trading. It's not just about learning the terms and theories; it's about understanding the pulse of the market, predicting trends, and making smart, calculated decisions. This Stock Trading course is your roadmap to becoming a savvy investor.

As you progress, you'll discover that stock trading is more than just numbers and charts; it's a psychological journey as well. The Stock Trading course addresses the mental and emotional aspects of trading, equipping you with the resilience and mindset required to succeed. It's not just a course; it's a transformational experience that prepares you for the real-world challenges of stock trading. Embark on this journey to unlock your potential and carve your path in the world of stock trading.

Learning Outcomes

- Acquire a comprehensive understanding of stock trading, including market indices and investment types.

- Develop the ability to differentiate between short-term and long-term investments and their respective strategies.

- Gain proficiency in fundamental and technical analysis, including reading stock charts and understanding market trends.

- Learn the principles of investment theories and strategies, like value and growth investing.

- Master the art of fundamental analysis, including quantitative and qualitative assessment of stocks.

- Understand the nuances of technical analysis, including chart patterns and indicators.

- Enhance knowledge of industry analysis, brokerage orders, trading techniques, and risk management.

Why prefer this Course?

There are many reasons to take our in-depth Stock Trading Course. Here are a few:

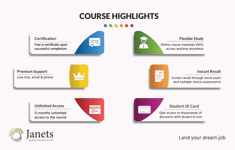

- QLS-endorsed courses.

- From Monday through Friday, complete tutor support is offered.

- Full access to course materials for a full year.

- Immediate assessment findings

- A free PDF certificate (CPD) is awarded after passing the courses.

- Study the subject of the courses at your own pace.

- Simple-to-understand modules and are taught by professionals

- Ask our email and live chat teams for assistance or guidance at any time.

- Utilise your computer, tablet, or mobile device to study at your own pace while finishing the courses.

Enrol in the Stock Trading course to find out more about the topic and get one step closer to reaching your desired success!!

CPD

Course media

Description

The Level 4 Diploma in Stock Trading is an in-depth, QLS Endorsed course designed for individuals aspiring to master the stock market. Spanning ten comprehensive modules, it covers everything from basic stock market concepts to advanced trading strategies and risk management. This Stock Trading course delves into fundamental and technical analysis, industry evaluation, trading psychology, and fraud awareness. It's ideal for those seeking a thorough understanding of stock trading, aiming to develop the skills needed for successful investing.

Each session in this Stock Trading course is thorough and easy to understand. The extensive course materials of Stock Trading are accessible at any time and from any location, allowing you to study at your own speed in the comfort of your own home. Throughout the course, you will receive tutor support, and our helpful customer service is available around the clock to help you with any problems you might face while studying Stock Trading course.

Course Curriculum:

Module 01: What Is Stock Trading?

Topics to Be Covered:

- Stock Market

- Stock

- Stock Market Index

- Short-Term versus Long-Term Investment

- Stock Investing versus Trading

- Investing in Stock

Module 02: Basics

Topics to Be Covered:

- Random Walk Theory

- Fundamental and Technical Analysis

- How to Read Stock Charts

- Stock Investing – Value Investing

- Stock Investing – Growth Investing

Module 03: Investment Theories and Strategies

Topics to Be Covered:

- Fundamental Analysis

- Discounted Cash Flow (DCF)

- Index Investing

- Understanding Volatility

- Risk and Risk-Adjusted Performance

- Value Investing

- Growth Investing

- Small Companies or Large Companies?

- Market Timing

- Technical Analysis

Module 04: Fundamental Analysis

Topics to Be Covered:

- What Is Fundamental Analysis?

- Fundamentals: Quantitative and Qualitative

- Quantitative Meets Qualitative

- The Concept of Intrinsic Value

- Qualitative Factors – The Company

- Qualitative Factors – The Industry

- Financial Statements

Module 05: Technical Analysis

Topics to Be Covered

- What Is Technical Analysis?

- Fundamental versus Technical Analysis

- The Use of Trend

- Support and Resistance

- The Importance of Volume

- What Is a Chart?

- Chart Types

- Chart Patterns

- Moving Averages

- Indicators and Oscillators

Module 06: Analysing Industries

Topics to Be Covered:

- Badgering the Witness and Interrogating the Industries

- Is the Industry Growing?

- Are the Industry’s Products or Services in Demand?

- What Does the Industry’s Growth Rely On?

- Is this Industry Dependent on Another Industry?

- Who are the Leading Companies in the Industry?

- Is the Industry a Target of Government Action?

- Which Category Does the Industry Fall Into?

- Outlining Key Industries

- Real Estate

- The Auto Industry

- IT Sector

- Financial Sector

Module 07: Understanding Brokerage Orders and Trading Techniques

Topics to Be Covered:

- Checking Out Brokerage Orders

- Time-Related Orders

- Condition-Related Orders

- Buying on Margin

- Examining Marginal Outcomes

- Maintaining Your Balance

- Going Short and Coming Out Ahead

- Setting up a Short Sale

- Going Short When Prices Grow Taller

- Watching Out for Ticks

- Feeling the Squeeze

Module 08: Recognising the Risks

Topics to Be Covered:

- Exploring Different Kinds of Risk

- Financial Risk

- Interest Rate Risk

- Understanding the Adverse Effects of Rising Interest Rates

- Market Risk

- Inflation Risk

- Political and Governmental Risks

- Minimising Your Risk

- Gaining Knowledge

- Taking Time

- Getting Your Financial House in Order

- Diversifying Your Investments

- Weighing Risk Against Return

Module 09: Trading Psychology

Topics to Be Covered:

- Trading Psychology

- Emotions of Trading

- Getting Out of Bad Trade

- Trader’s Commandments

- Become a Pro

Module 10: Stock Trading Frauds

Topics to Be Covered:

- Unsolicited Calls and E-mails

- Understanding Stock Trading

- The Promise of Extraordinary Returns

- Verify the Investment

- The Broker

- Pump-and-Dump

- Short-and-Abort

- Verifying Sources

- Recovering

Method of Assessment

To successfully complete the Stock Trading course, students will have to take an automated multiple-choice exam. This exam will be online, and you will need to score 60% or above to pass the Stock Trading course. After successfully passing the course exam, you will be able to apply for a certificate as proof of your expertise.

Who is this course for?

The Stock Trading course is ideal for:

- Individuals aspiring to become stock traders.

- Finance students seeking specialized knowledge in stock trading.

- Business professionals interested in diversifying their investment portfolio.

- Entrepreneurs wanting to understand market dynamics for better business decisions.

- Career changers looking for opportunities in the finance sector.

Requirements

The Stock Trading is open to all students and has no formal entry requirements. To study the Stock Trading course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16.

Career path

Stock Trading Course is ideal for anyone who wants to pursue their dream career in a relevant industry, including:

- Stock Trader: £35,000 - £100,000

- Financial Analyst: £30,000 - £60,000

- Investment Advisor: £40,000 - £70,000

- Portfolio Manager: £50,000 - £120,000

- Market Research Analyst: £25,000 - £55,000

- Risk Manager: £45,000 - £85,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

QLS Endorsed Hardcopy Certificate

Hard copy certificate - £79

Level 4 QLS Endorsed Hardcopy Certificate

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.